Fed Open Market Operations

Historically, the Fed has maintained its target overnight rate by open market operations. When the Fed funds rate drifts above target, the Fed injects money into the market by buying loans, and when it drops below target, the Fed sells those same loans to bring it back up to target*. When the Fed injects money, it gets converted into bank reserves, which the banks then lend out into the market, thus increasing supply and reducing rates. This essentially requires the Fed to use its balance sheet of securities, and target the level of bank reserves in order to maintain a given level of interest rates.

The Role of IOR

Paying interest on reserves allows the Federal reserve to separate interest rate policy from bank reserve policy. As Marvin Goodfriend puts it .

Essentially, paying interest on reserves allows the Fed to put a floor under overnight interest rates. In response to a "shock to financial markets", i.e., a financial crisis, the Fed can stabilize the market by flooding it with reserves secure in the knowledge that overnight rates will be maintained by the interest rate paid on reserves. The bank can directly control interest rates, without worrying about its balance sheet or the impact of injecting more reserves into the market.

Paying interest on reserves allows the Federal reserve to separate interest rate policy from bank reserve policy. As Marvin Goodfriend puts it .

"Why might a central bank value the latitude to pursue separate interest rate and bank reserves policies? Interest rate policy could continue to be utilized to maintain overall macroeconomic stability. Bank reserves policy could then address financial market objectives. In the long run, a central bank could pursue an objective for bank reserves to optimize the broad liquidity services provided by the floating stock of government debt. In the short run, for example, a central bank could increase bank reserves in response to a negative shock to broad liquidity in banking or securities markets or an increase in the external finance premium that elevated spreads in credit markets. The increase in bank reserves would help to stabilize financial markets by offsetting the temporary reduction in the private supply of broad liquidity. The latitude to pursue bank reserves policy and interest rate policy separately would be useful to the extent that shocks in financial markets and the macroeconomy are somewhat independent of each other. "

Essentially, paying interest on reserves allows the Fed to put a floor under overnight interest rates. In response to a "shock to financial markets", i.e., a financial crisis, the Fed can stabilize the market by flooding it with reserves secure in the knowledge that overnight rates will be maintained by the interest rate paid on reserves. The bank can directly control interest rates, without worrying about its balance sheet or the impact of injecting more reserves into the market.

Timing of introduction

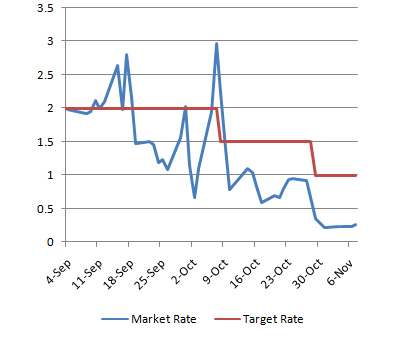

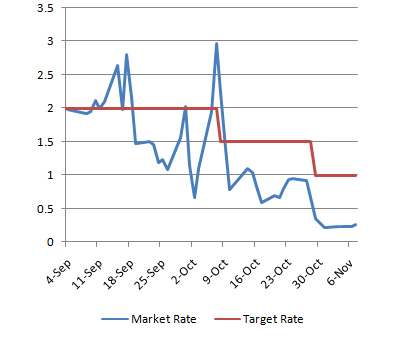

Its no surprise that the Fed introduced the policy of paying interest on reserves in October 2008. One result of the financial crisis was that the demand for reserves skyrocketed, and the Fed had to flood the market with reserves in order to stabilize it. This made it increasingly difficult to keep the actual overnight rate anywhere near the target rate as is clear from the graph below

In those crazy times, IOR helped the NY Fed to put a floor below interest rates and stabilize the market, just as it was supposed to.

In those crazy times, IOR helped the NY Fed to put a floor below interest rates and stabilize the market, just as it was supposed to.

Its no surprise that the Fed introduced the policy of paying interest on reserves in October 2008. One result of the financial crisis was that the demand for reserves skyrocketed, and the Fed had to flood the market with reserves in order to stabilize it. This made it increasingly difficult to keep the actual overnight rate anywhere near the target rate as is clear from the graph below

In those crazy times, IOR helped the NY Fed to put a floor below interest rates and stabilize the market, just as it was supposed to.

In those crazy times, IOR helped the NY Fed to put a floor below interest rates and stabilize the market, just as it was supposed to.Why continue paying IOR?

With interest on reserves being paid at 0.25%, IOR currently serves as nothing more than a floor to keep overnight rates somewhere in the Fed's 0 - 0.25% range. Despite what some might say, its hard to believe that cutting IOR to o.15% or 0% would do much to force banks to lend out their excess reserves. And without any stabilizing influence on the market, you might start seeing destabilizing swings of the October 2008 variety again.

A side-effect of IOR is that it allows the Fed to manage interest rates without using its balance sheet. With open market operations, the Fed has to sell securities to raise interest rates. This raises two problems: firstly, the Fed may not have enough securities** to raise the rate as high or as quickly as it wants to; and secondly, the Fed may be forced to take losses on the securities it sells if it has to sell them at a price below what it paid.

The second problem is likely to be the biggest factor in the Fed's continued payment of IOR. Despite its ongoing efforts to flood the market with reserves, the Fed will soon have to start planning its exit from the current low interest rate environment. If it used the securities on the balance sheet to do this, it would have to sell them at a loss, and deplete its capital.

So the final reason for the Fed to maintain an interest on reserve policy is independence from Congress. Essentially, paying interest allows the Fed to issue its own riskless overnight debt, instead of having to rely on riskless debt created by the Treasury. When the time comes to raise interest rates, the Fed can do so using its own debt, and not beholden to the Treasury or to Congress, either for debt issuance, or for additional capital.

* The NY Fed actually uses repos or reverse repos to do this.

** Or enough of the right kind and duration.